Smartly managing finance and technology risks associated with new technologies is the key!

We frequently find ourselves experimenting with cutting-edge products and technology in our daily lives. However, the marginal cost of technology adoption at a personal level is very low and hence could be borne by individuals. However, in industries, state-of-the-art infrastructure development involves large investments, with associated financial and technology risks.

“The price of the freedom to innovate with new technologies is eternal vigilance in the face of its risks.”

It is evident that the industry as a whole takes extreme caution when utilizing new factors in business that represent risks and uncertainties, such as additive manufacturing, drones, blockchain, the internet of things, 5G, and artificial intelligence. Industrial engineering routines also include user testing, experiments, prototyping, verifications, and inspections of all kinds to try to ensure that everything that potentially poses a relevant risk is adequately addressed. One of them is early risk analysis, which reduces costs and saves time by preventing costly blunders at the project’s later implementation and distribution phases. Uncertain outcomes are frequently predicted using methods like quantitative risk management (QRM) and decision-making under uncertainty (DMU).

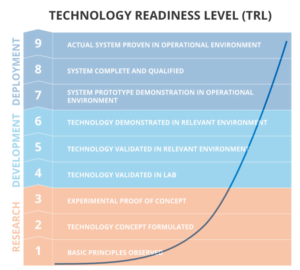

Rapid scale-up, aggressive industry scale testing and experimentations, and object-oriented research and development is the key to adapting to alternative technologies. The growth of TRL for technologies has to be rapid. Adapting to clearer raw materials, fuels, and processes can make a huge impact. Hard-to-abate industries need to work simultaneously on reducing the Scope 1 and Scope 2 emissions, by tracking the carbon footprint of their upstream suppliers and demanding more transparency in the supplied material’s carbon intensity.

However, making changes in the key processes can have unparalleled reductions to the emissions from industries. Not to forget, scope 1 of each industry is scope 2 and 3 of some other industry.

Investment in climate financing fell off in the 2010s, but it is now starting to pick up again thanks partially to the renewed awareness of the ongoing climate crisis. Financial risks could be mitigated using climate finance. Financing required to achieve the adaptation and mitigation goals is expected to be trillions of US dollars per year until 2050. However, it has only been seen that only a fraction of this is dedicated to annual climate finance distributed globally, with just a small portion going to developing nations.

Companies can design new technology and enhance their current products through collaborative R&D, adapt multiple solutions at relevant scales, and take multiple approaches to decarbonization, which benefits long-term profitability. One recent example is Tata Steel, which has stated its intention to move to hydrogen-based steelmaking and has the ambition to manufacture CO2-neutral steel in Europe by the year 2050. For Tata Steel to achieve these targets, new processes, technologies, and unconventional changes need to be made to existing blast furnaces. Hydrogen injection in a blast furnace recently done at the plant in Jamshedpur is an excellent example of Rapid scale-up, aggressive industry scale testing and experimentations, and object-oriented research and development.

Setting Net-zero targets is important but taking action to achieve net zero is just as essential. I’ll talk more about setting net zero targets in the next article.